Introduction: The Role of Fundamental Analysis in Forex Trading

Fundamental analysis is essential for understanding the long-term movements in the Forex market. It focuses on evaluating macroeconomic factors such as inflation, interest rates, and political stability, which impact the supply and demand of currencies. Traders who use these strategies aim to gain a deeper insight into global economic trends and how they influence currency values.

In this article, we will discuss some of the most reliable fundamental Forex trading strategies, breaking down how economic data and geopolitical events impact currency movements.

1. Interest Rate Differential Strategy

Interest rate differentials between countries significantly influence currency values, making them one of the most important factors in Forex trading. Central banks adjust interest rates to control inflation and stimulate economic growth, and these decisions can drive currency demand.

How It Works:

A country with higher interest rates attracts more foreign capital as investors seek better returns. As a result, the demand for the currency increases, leading to appreciation. On the other hand, currencies from countries with lower interest rates tend to weaken.

Example: In 2023, the U.S. Federal Reserve raised interest rates multiple times, making the U.S. dollar more attractive to investors compared to the Japanese yen, where interest rates remained close to zero. This led to the strengthening of USD/JPY throughout the year.

Strategy Application:

Traders should closely follow central bank meetings and interest rate decisions to determine the likely direction of currency movements. Identifying currency pairs where the interest rate gap is expected to widen or narrow can provide profitable opportunities.

2. Economic Data-Driven Strategy

Economic reports are a cornerstone of fundamental Forex trading. These reports provide insights into a country’s economic health, directly affecting currency strength or weakness. Key economic indicators, such as GDP growth, inflation, and employment data, can cause short- to medium-term volatility in the Forex market.

Key Economic Reports:

Gross Domestic Product (GDP): A higher GDP growth rate suggests a healthy economy, which typically strengthens the currency.

Inflation (CPI): Rising inflation can lead to central banks increasing interest rates to curb inflation, boosting the currency's value.

Employment Reports: High employment rates signal economic strength, while rising unemployment can indicate a weakening economy.

Example: In mid-2022, the U.S. reported strong job growth, with unemployment hitting historic lows. This boosted the U.S. dollar as traders anticipated further interest rate hikes from the Federal Reserve.

Strategy Application:

Traders should monitor economic calendars to stay informed about upcoming data releases. Preparing trades before the release of key reports, such as non-farm payrolls in the U.S. or inflation figures from the Eurozone, allows traders to capitalize on market reactions to these economic announcements.

3. Geopolitical Event Trading

Geopolitical events, including elections, international trade agreements, and regional conflicts, can have significant impacts on currency values. These events introduce uncertainty into the markets, causing volatility as traders react to the potential economic implications.

How It Works:

Elections: Political instability or major policy shifts following elections can lead to currency depreciation, while stability and pro-growth policies can strengthen the currency.

Trade Wars: Disputes between major trading nations can weaken currencies heavily reliant on exports.

Regional Conflicts: Wars and regional tensions often result in a flight to safe-haven currencies such as the U.S. dollar, Swiss franc (CHF), or Japanese yen (JPY).

Example: The U.K.’s Brexit negotiations throughout 2019 and 2020 created significant volatility in the British pound (GBP), as uncertainty over trade agreements and economic relations with the EU caused dramatic price fluctuations.

Strategy Application:

Traders can use geopolitical event trading by staying informed about global political developments. Risk management is crucial, as these events often cause unexpected price movements. Safe-haven currencies like CHF and JPY can serve as hedges during times of increased uncertainty.

4. Commodity-Linked Currency Strategy

Certain currencies are highly correlated with global commodity prices, particularly those of countries that rely heavily on commodity exports. These commodity-linked currencies tend to move in tandem with price changes in key commodities such as oil, gold, or agricultural products.

How It Works:

Canadian Dollar (CAD): Highly influenced by oil prices, as Canada is one of the world’s largest oil exporters.

Australian Dollar (AUD): Closely tied to global demand for raw materials, particularly metals and minerals.

Russian Ruble (RUB): Strongly impacted by oil prices due to Russia’s dependence on oil exports.

Example: In early 2022, oil prices surged following supply concerns due to geopolitical tensions in Eastern Europe. As a result, the Canadian dollar appreciated against major currencies like the U.S. dollar, as traders anticipated higher demand for oil.

Strategy Application:

Traders can use commodity price data to predict currency movements, especially when there is a strong correlation between a country’s economy and specific commodity prices. Monitoring changes in global commodity markets provides insights into potential shifts in the value of commodity-linked currencies.

5. Carry Trade Strategy

Carry trades involve borrowing in a low-interest currency to invest in a higher-yielding currency, profiting from the interest rate differential. This strategy is most effective in stable market conditions, where currency pairs are not expected to experience large fluctuations.

How It Works:

Traders borrow a low-yielding currency, such as the Japanese yen, and invest in a higher-yielding currency like the New Zealand dollar. The profit comes from the interest rate difference between the two currencies.

Example: The Australian dollar (AUD) has historically been a popular currency for carry trades due to its higher interest rates compared to the Japanese yen. Traders borrowed yen at low rates and invested in Australian assets, earning both interest and potential appreciation in AUD.

Strategy Application:

The carry trade strategy requires monitoring global interest rate differentials and central bank policies. It is also essential to consider the market’s volatility, as the carry trade works best in calm, trending markets where sudden currency fluctuations are less likely.

Conclusion: Implementing Fundamental Forex Strategies

Fundamental Forex trading strategies are essential for traders looking to gain a deep understanding of the global economic factors that influence currency markets. By focusing on interest rate differentials, economic data, geopolitical events, and commodity correlations, traders can anticipate and capitalize on market movements.

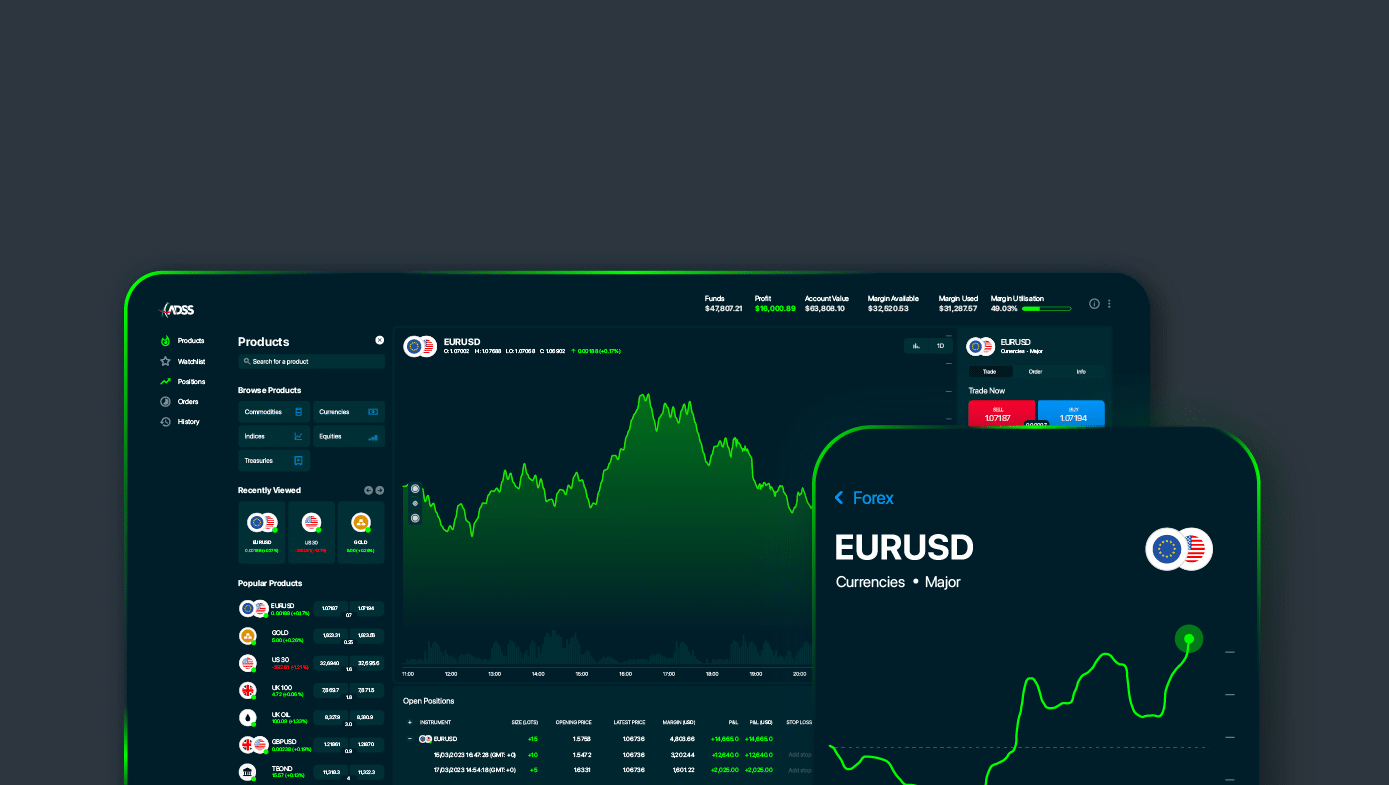

Our platform provides the tools and resources necessary for traders to apply these fundamental strategies, offering real-time data, access to economic calendars, and expert analysis. By implementing these strategies effectively, traders can navigate the complexities of the Forex market and improve their trading performance.

Increase your profit margins with every trade by accessing top forex rebates!